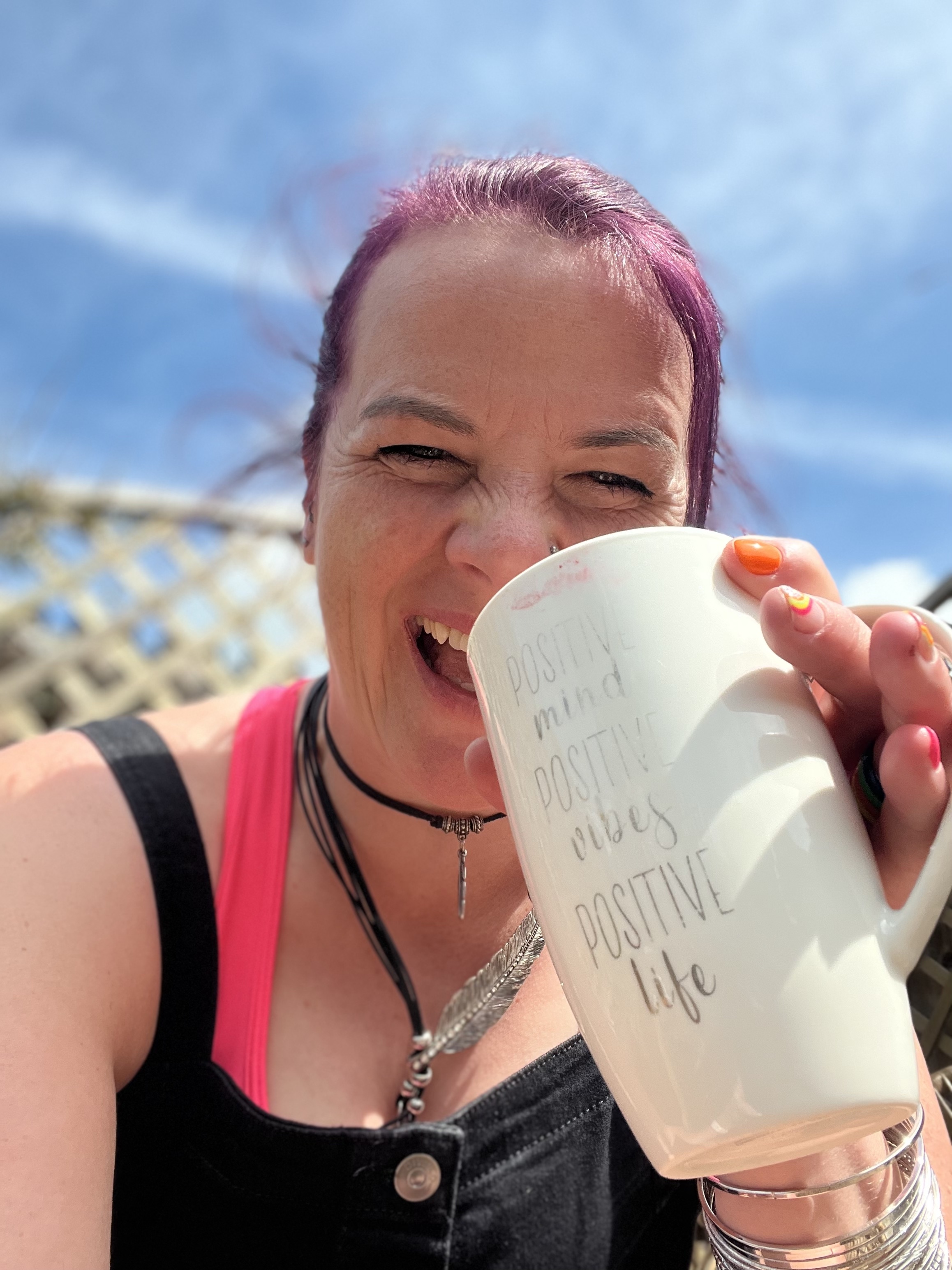

THE ANTI-HUSTLE CLUB

Blog

THE ANTI-HUSTLE CLUB

Blog

Transforming Your Money Mindset: Facing Your Financial Fears: A Guide for Female Business Owners - Day 3

STOP RUNNING AWAY FROM YOUR FINANCES

I am shocked at how common this is amongst female business owners.

Hiding from financial commitments, debts and responsibilities and investing every last penny of credit on yet another 5 step framework to 10k months 🥴

I'm not judging - I've totally been there! I'm hoping this sage advice will help so please share it.

I've been in terrifying amounts of debt in my life and I totally get the whole not opening post and never answering the door thing. It's grim.

However here is something I know to be unequivocally true:

All hiding does is make you feel like utter shit. Exhausted, wrung out, terrified. Not fun.

And sometimes you can feel this way ⬆️ without having experienced severe debt. Just the IDEA of receiving large amounts of money can have your nerves in tatters.

So.. face it!

What is the worst that can happen? Think it through and make a plan. I promise you will feel so much better if you make a solid plan.What is it about the debt that you are in that feels so scary? Is it going homeless? Everyone finding out? Sit and face it all. Debt charities are there to help so use them. Speaking to the people you owe money to is ALWAYS better than hiding, both for your own peace of mind and in terms of repercussions.

Subconsciously blocking money because you are scared of having it? (You'll know this by how the idea of $20k landing in your lap from paying clients actually feels in your body). Again, think through all the worst case scenarios and make a plan.

I'm scared of taxes. Possibly a hangover from my parents. I just pay a standing order so I know it's getting paid. Simple.

This exercise will also help you a lot if you have a pattern of being unable to hold money.

Please stop trying to control and fix everything externally and address the crap circulating within your own mind.

Not only will this bring you huge amounts of peace but it will also create alignment and allow money to flow in to you.

Facing your finances is imperative if you want to actually change your situation. Look at every penny you earn, spend and owe. Know it inside and out. List out your goals in minute detail and know how much those goals will cost. It's impossible to call in money if you don't even know how much you need!It may feel like a lot and it may take several hours to complete these tasks but once it's done, and once you've faced and addressed how you actually feel about money in general and your specific money situation, then we can move forward in our own power.

I've done this exercise and even though I would consider myself to be quite on top of my money, I was actually £1000 out on my expenditure! A thousand pounds of expenses I hadn't accounted for PER MONTH! Whoops!

It's super important to do this work because I promise you if you try and gloss over it, if you refuse to open your bills or look at your bank balance or otherwise face reality then your reality is not going to change. Magic can happen at any time but what you want to do first is to change the story you are running in your mind because that ultimately runs the show and the way to change the story is to face what's going on and arm yourself with facts and a best way to proceed.

The Exercise

Sit and think through the worst case scenarios regarding your money fears, what is the worst that can happen if I don't pay my bills, if I don't earn money today/tomorrow/next week? What will actually happen in my worst case scenario? Then make a 'Worst Case Scenario Plan'. Write it out and put it away. Phew, that's that dealt with!

Go through your finances with a fine tooth comb and write out all of your income and expenditure, and your debts. Figure out how much you need to meet your needs each month and then figure out how much you need to add to that to start paying for some of the desires you listed out yesterday over the next six months. Work out a monthly amount. Great, now you have a goal!

Think about what you need to do to make this happen. Often it's not just doing more or working harder. This is usually a holistic thing. So what do you need to focus on and what do you need to cut out? Example: I recently cut out 99% of the sugar I was consuming (which was a lot) and the knock on effects of that were better sleep, earlier rising, more inclination to exercise, more inclination to stick to healthy eating, much more energy and creativity, far fewer aches and pains - the list goes on!

It might take quite some time to get all this together but it's important that you do because from today onwards we are going to track and stay on top of our money and we are going to set intentions around our money goals DAILY.

Good Luck!

If you are interested in how I coach the whole human to create transformational success in self leadership and business, send me a message on social media.